The Federal Reserve’s efforts to curb inflation might bring a subtle relief in lowering gas and food prices, but for homebuyers and renters, it may be too little too late.

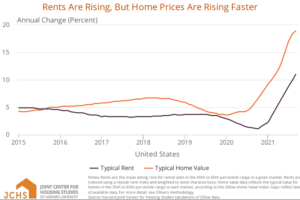

As home prices increased by nearly 30% in the past decade, apartment rents increased precipitously, as did single-family rents. At the same time, the housing supply fell dramatically, according to a 2022 release by the Joint Center for Housing Studies (JCHS).In addition, John Burns Real Estate Consulting reported the market value of single-family rental (SFR) homes in 2022 at $4.7 trillion, doubling over the past decade.

Moody’s Analytics reports that apartment rents are 30% of a renter’s income due to competition from higher home prices. Meanwhile, if renters want a single-family home, their debt-to-income ratio will likely hit at least 36% to 41% on a mortgage application.

That’s not bad news for mortgage lenders since financing a home can help with adding tax deductions, but home prices have been pushing first-time homebuyers out of the market. While Fannie Mae’s Home Purchase Sentiment Index this month says high mortgage rates and job concerns caused nearly 80% of survey respondents to say that now is not a good time to buy a home, 82% of respondents in last month’s Home Purchase Sentiment Index listed high home prices and high mortgage rates.

In lowering rates not just in the past ten years but the past 35 years, the Federal Reserve has generated enough capital to chase products in the forms of commercial real estate bubbles prior to the Savings and Loan crisis, the dot-com bubble prior to the dot-bomb and the housing bubble prior to the crash leading to the Great Recession.

After Wall Street flooded the RMBS market with cheap capital, liquidity in the mortgage market soared, and lenders like Countrywide Mortgage were just giving away mortgages to consumers with a signature. So with all that liquidity, how could they lose?

Unemployment, homes underwater, and foreclosures flooded neighborhoods as the result of a systemic financial disaster and a global economic crash that hit the world.

As a result, the Fed lowered rates to nearly zero and once again provided the same “cheap” capital for the same Wall Street investors to spend as they wanted. This time, investors couldn’t trust RMBS, so they invested directly in housing, specifically the foreclosed homes vacated due to their previous capital rush years before.

When home prices bottomed out in 2012 and rates remained low, institutional investors and some smaller investor groups started acquiring more houses. Nearly 15% of homes sold were bought by investors in 2012, and in 2021, nearly one-quarter of homes were purchased by investors. Institutional investors added property management firms to create a single-family rental (SFR) market. Investors like Blackstone and Starwood emerged along with real estate investment trusts (REITs) so that investors could generally invest in SFR homes without owning or buying a home.

The “homeownership” in this situation had an abundance of capital in their pockets through REIT investors, and no foreclosures were going to happen on their watch.

A few years ago, limited housing inventory, less construction, and more SFR homes heated homebuyer competition during a pandemic with record low mortgage rates. The pandemic caused the Fed to lower rates back to nearly 0 competition, and the floodgates opened again for institutional investors. Home prices soared to artificial highs. But most recently, as the Fed focuses on an overheated market, it is raising its rates, and, as an indirect result, mortgage rates are increasing. The combination of unaffordable home prices heated competition for higher apartment and single-family rent prices; therefore, lower-income families have been priced out of affordable shelters.

While housing advocates might say that investor-owned SFRs and limited single-family inventory are unrelated, CNBC reported MetLife Investment Management figures that show institutional investors owned roughly 5% of the 14 million single-family rentals nationally in early 2022 and institutional investors may control 40% of U.S. single-family rental homes by 2030.

Despite the SFR market forming for the past decade, a backlash from Washington has started. In October 2022, nearly five months after President Biden announced the Housing Supply Action Plan, CNBC reported that California Democratic Rep. Ro Khanna would lead author the Stop Wall Street Landlords Act of 2022. In December, the Securities and Exchange Commission (SEC) recently investigated Blackstone and Starwood, two companies that merged into America’s “biggest landlord” in 2017. In November 2019, Blackstone sold off its stake in Invitation Homes for $1.7 billion, but Invitation Homes, a public company, is still alive and well, trading as a REIT on the S&P stock exchange. There has been little, if anything, reported from the SEC.

As Wall Street investors keep their money in single-family rental REITs like Invitation Homes, it’s rather difficult to simply break it all up.

Similar to the housing crisis of 2008, when the Dodd-Frank Act was drafted well after the damage had been done, unregulated institutional investors buying foreclosed homes have pushed out first-time homebuyers from the housing market.

Home prices have been the most significant sign of inflation since the pandemic started. Still, the housing market is arguably headed for stagflation as the country is looking at signs of a recession.

This week, Biden has added incentives to close the housing gap in his budget.

Cost incentives and reducing barriers to housing construction may increase inventory and help first-time homebuyers back into the housing market. Of course, downpayment assistance of $25,000 wouldn’t hurt either, but when will future homebuyers expect homes to become more affordable?

Catching up on ten years of institutional investment into single-family homes is a tough job for this Administration, but getting families into affordable homes and rental properties should be a top priority because it would go a long way to increasing approval ratings for President Biden, especially before the 2024 election.

______________________________________________________________________________________________________________________

Michael Murray

Michael Murray is Director of Communications at Strategic Vantage, a PR and marketing firm based in Miami, Fla., serving the mortgage banking industry. As a Board Member for NAMI Montgomery County, Md., Michael helped create a scholarship for HBCU students focusing on mental health studies. In addition to blogging, Michael edits and writes plays–some performed on radio, television, and theater. He graduated with an English degree from the College of William and Mary.