On January 3, 2022, the S&P 500 recorded an all-time high on a continued recovery in economic growth and earnings expectations from the pandemic-induced recession and bear market. Indeed, the S&P 500 witnessed a near-27% surge in price in 2021. Through May 12, 2022, however, the S&P 500 had fallen 18%, while the Nasdaq and Russell 2000 index of small-cap companies had each tumbled by nearly 30%. This weakness was driven by the start of a new rate-tightening cycle by the Federal Reserve, along with soaring oil prices (which touched $130 per barrel earlier this year) and inflation (since the headline CPI for February recorded an 8.5% Y/Y rise in March). In addition, Russia invaded Ukraine, which triggered a surge in geo-political tensions, along with grain and oil prices.

Many investors were surprised by the early selloff in stocks, but history reminded them that it was natural to expect digestion following last year’s more than 20% surge. Also, stocks were vulnerable to a decline, due to the elevated valuation of the broad market, as measured by the S&P 500’s Price-to-Earnings Ratio (P/E Ratio).

Due to the recent carnage, many wonder if they should bail out of stocks? For the average investor, the correct answer is no, since market timers have to be right twice: once when to get out and again when to get back in. In addition, some think that investing is merely gambling. While we agree that trying to time the market is similar to gambling, long-term investing is not, because the stock market has posted a positive total return in 80% of all calendar years since WWII, and recorded a compound annual total return of 11.3%. How many casinos do you know pay the gambler 80% of the time and deliver 11%+ annual returns on their bets?

Typical Tumble

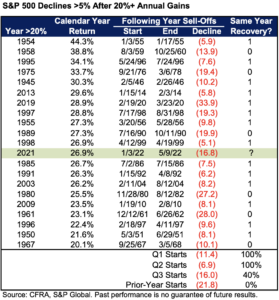

Amazingly, history warned investors that the equity market weakness experienced thus far in 2022 is not unusual. Indeed, in the 20 years following calendar-year gains of 20% or more since WWII, the S&P 500 subsequently declined by 5%+ declines each time, with nine of them starting in Q1, three in Q2, and five in Q3. In addition, we never had to wait beyond September to experience a much-needed resetting of the dials. What’s more, three times – 1961, 1967, and 1980 – the S&P 500 got an early start on its sell-off by peaking before the 20%+ year was over.

Of the 12 declines that started in the first half of the new year, all 12 got back to breakeven (recovering all that was lost) before the year was out. Yet only 40% of those that started in Q3 recovered all that was lost before year-end. Finally, none that jumped the gun by peaking in the prior year saw breakeven until a year or more later.

Using History as “Virtual” Valium

As a result of this uncertainty, the worst thing investors can do is allow their emotions to become their portfolio’s worst enemy, since elevated volatility would likely cause them to buy at the top and sell at the bottom, while playing a losing game of “Whack-a-Mole” along the way.

One thing that investors should realize is that volatility is natural within the world of investing. Since WWII, 5%+ decline/recovery phases typically occurred every 100 calendar days, meaning that if the market declined by 5% or more and then got back to breakeven, it typically slipped into another decline of 5% or more an average of only 100 calendar days later. Therefore, one would think that investors are used to frequent selloffs. But they aren’t. That’s why fear is regarded as a stronger emotion than greed. Indeed, there is an old saying: “Bull markets take the escalator, while bear markets take the elevator.”

Seasonality can also play a part in volatility. The six-month stretch between May and October has traditionally recorded the weakest average six-month price change since WWII (up only 1.7%), while the November-through-April period has been the strongest (with a 6.8% average climb). Volatility has also been higher from May through October, hence the old adage to “sell in May and go away.”

The four-year Presidential Cycle has also played a part in market returns and volatility. This year (2022) is a mid-term election year, which has traditionally endured 40% more volatility than the average for the other three years of the Presidential Cycle. It has also recorded the weakest annual return at 5.0% versus the third year of the president’s four years in office (2023), which has traditionally been the strongest, rising about 16.0% on average.

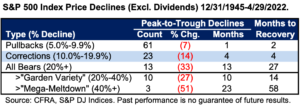

In order to isolate and analyze meaningful market declines, thereby using stock market history to soothe one’s nerves, investors should understand that there are three types of selloffs: 1) pullbacks, or declines of 5.0% to 9.9%, corrections (-10% to -19.9%), and bear markets (-20%+). Some further divide bear markets into “garden variety” (-20% to -39.9%) and “mega-meltdowns” (-40%+). Anything less than -5% should be considered “noise.”

Since 1945, as seen in the accompanying table, there have been 61 pullbacks. Each declined an average of 7% in price, taking one month to go from peak to trough and an average of fewer than two months to get back to breakeven. The recovery time corrections have been more impressive, which declined an average of 14% in four months, then taking only another four months to recover all that was lost. There have been 10 “garden variety” bear markets since WWII, which fell an average of 27% over a 10-month period that took 14 months to get back to breakeven. Lastly, there have been only three “mega-meltdowns” since 1945 (1973-75, 2000-02, and 2007-09). These declined an average of 51% over 23 months, which required 58 months to recover everything.

An important point to consider is that when markets sell-off, many investors believe they “lost” money, and decide to sell to stop the hemorrhaging. Yet in reality, investors who own the broad market only lose money when they sell out. By ignoring your emotions and holding on while the decline runs its course, the “paper loss” will eventually recover. Along the way, if you feel the urge to do something, feel free to rebalance your portfolio, or better yet, generate a shopping list of high quality/high yielding companies that now trade at deep discounts.

Sam Stovall

As Chief Investment Strategist, Sam Stovall serves as analyst, publisher, and communicator of CFRA’s outlooks for the economy, market, and sectors. He is the author of The Seven Rules of Wall Street and The S&P Guide to Sector Investing. He also writes weekly “Sector Watch” and “Investment Policy” reports on CFRA’s MarketScope Advisor platform, and maintains the Industry Momentum and Seasonal Rotation portfolios. His work is also found in CFRA’s flagship weekly newsletter The Outlook.