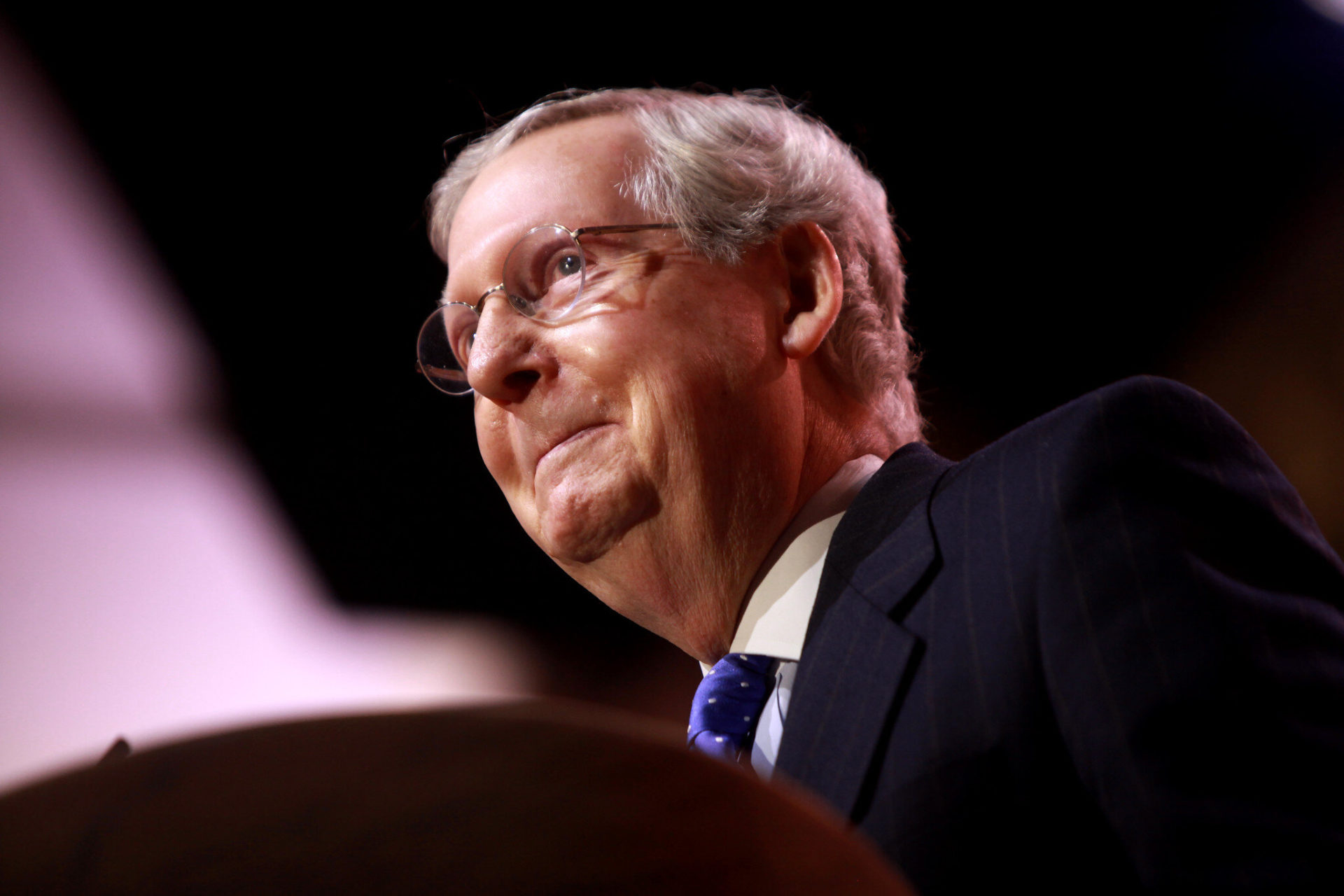

There is an odd meme going around these days that suggests that Sen. Mitch McConnell blinked. With less than two weeks left before the Treasury was due to run out of cash, McConnell backed down on his threat to filibuster any extension of the debt limit, and instead supported a short-term extension of the deadline, giving Democrats two months of breathing room to work things out.

But nothing is that simple with McConnell, who sees everything through the lens of political advantage. Far from giving Democrats a breather, he made clear that he wants to force them to use a process called “budget reconciliation,” which would allow the debt ceiling to be raised with only 50 votes but takes more than two weeks to put into effect.

This would achieve two objectives at once. First, by using budget reconciliation, McConnell would force Democrats to specify the dollar amount of any debt ceiling increase, which Republicans could then hang around the necks of Democrats in the upcoming midterm elections. Second, there are limits to how often the budget reconciliation process can be used in a fiscal year. Forcing Democrats to use the process to address the debt ceiling would limit their ability to circumvent GOP filibusters between now and next October.

For years now, raising the debt ceiling has become a ritual imbued with unsurpassed political hypocrisy. Time and again, we watch the same politicians who were only too willing to help amass trillions upon trillions of dollars of red ink, grandstanding as they point the finger at anyone but themselves when the debt ceiling vote rolls around. And each time, as we saw last week, the Secretary of the Treasury and Chairman of the Federal Reserve Bank dutifully march down to the Capitol, pound the table, and admonish members of Congress to put their partisan differences aside and do as duty calls, lest financial calamity befall us all – skyrocketing unemployment, an economy plunged into recession, savings lost, and lives destroyed.

McConnell has little regard for such warnings. He has been down this path fourteen times over the past two decades and knows how this movie ends. Notwithstanding the short-term extension agreed to this week, McConnel continues to maintain that Republicans will have no part of the debt ceiling vote, and knows that his members will follow his lead in lockstep. Indeed, not a single Republican Senator – not even “moderate” Republicans like Ohio’s Rob Portman or Missouri’s Roy Blount – have given any indication they will budge on the matter.

No one should be surprised, of course. Republicans, who normalized massive deficits during the Reagan Revolution, reliably get on their high horses when the time comes to raise the debt limit whenever a Democrat sits in the oval office, and this time is no different. The debt ceiling is itself a contrivance in the purest sense, as when the time comes when the debt ceiling has to be raised, the acts of fiscal profligacy that necessitated raising it have long passed.

If politicians, whether in Congress or the White House, oppose deficit spending and the issuance of debt that derives from it, they might consider introducing balanced budgets in the first place. But that would force them to actually do the heavy lifting of governing – balancing priorities of taxing and spending as the Constitution suggests they were elected to do.

Since Ronald Reagan changed the rules of the game, one GOP president after another has done their level best to push the public debt ever higher, even as they claimed to be fiscal conservatives. Indeed, the record shows that the GOP has consistently outperformed Democrats when it comes to piling up the red ink. Reagan and George H.W. Bush gave new meaning to the word profligacy, while Donald Trump outdid them all, piling up a record $8 trillion in new debt in a single term in office.

Fiscal conservatism, once the hallmark of Republicanism, has long been reduced to little more than a rhetorical device. Refusing to raise the debt ceiling after decades of pumping out red ink is not the hallmark of prudence, but rather a performative theatre of the most cynical sort, a truncheon with which to bludgeon Democrats before the GOP faithful.

Even as President Biden lashed out at Mitch McConnell this week for his debt ceiling gamesmanship, and refused to guarantee that the nation would not head over the fiscal cliff, the markets evinced little concern that a default on U.S. debt and the ensuing financial calamity predicted by Treasury Secretary Janet Yellen are in the offing. While the market suffered a mild correction, dropping 5% in September, it has already recovered most of those losses and remains up 29% over the past year.

Investors have many good reasons to be concerned about the state of the world; it is just that Congress’s ritual games of brinksmanship are nowhere near the top of the list. First and foremost, there is China to worry about. Forty years ago, China President Deng Xiaoping launched the transformation of the Chinese economy. It was an action that transformed the world, as it opened China up to world trade and caused seismic shifts in the world economy. It led, in turn, to China’s membership in the World Trade Organization; previously unimaginable declines in the percentage of the world population living in extreme poverty; the evisceration of the American middle class; political unrest and depression across the American heartland; and the rise of Donald Trump. China grew more prosperous, much of America grew less prosperous, and in both countries, income and wealth inequality exploded.

Over the past few months, China President Xi Jinping has changed course. Readers of the financial press know that he has implemented a dramatic crackdown on China’s largest corporations and wealthiest elites. He has moved the country away from its growth-at-all-costs policies toward the prioritization of “common prosperity.” Those changes, in turn, threaten to upend the rules of global trade and investment, and have contributed to stock market volatility over the past few months.

While some might imagine that the cascading evaporation of democracy in America before our eyes – The Economist magazine recently downgraded the United States from “Full Democracy” to a “Flawed Democracy” in its Global Democracy Index – would have unsettled global markets, the real driver of volatility over the past month or two appears to have been the Xi Jinping’s determination to veer away from Deng’s capitalist road and put a bit of Mao back in his step.

And along with turmoil in the world’s second-largest economy, there are plenty of other concerns for investors to focus on, before considering whether the debt ceiling is a real problem. There are continuing disruptions to global supply chains. Soaring global energy prices and supply shortages. There are fears of inflation and fears of deflation, and impacts on stock valuations. There are rising tensions in the South China Sea and the Straits of Taiwan and doubts about America’s commitments across the globe. Against that backdrop, Washington’s quasi-annual debt ceiling dance barely registers.

Somehow, investors seem able to look past most anything these days. As long as global interest rates remain near their historic lows, everything else seems to be discounted as just more noise in the social media soap opera of everyday life.

Until they don’t. Over the past few decades, each time the debt ceiling had to be raised and the ritual game of brinksmanship started, a voice whispered in the back of my mind, “What if things are actually different this time? What if this time they really don’t get it done?” And each time, of course, that voice recedes when members of Congress, often with just hours to go, belly up to the bar and behave like grownups. The debt ceiling is raised. Default is averted. Financial calamity waits until the next time around.

But what if things actually are different this time? Few imagined Donald Trump would get elected, but he did. Few could believe that a majority of Republicans in Congress would vote against the peaceful transfer of power, but they did. In this moment of historic dysfunction, could Congress actually fail to do its job?

Mitch McConnell did not blink this week, and he sees no such risk. He believes he has the strategic advantage because he knows that when push comes to shove, Democrats will never allow a default on their watch. But perhaps the outcome will not be the one he expects. Perhaps, after months of infighting, moderates and progressives will find common ground against a common. He is all but begging them to grasp the nettle and change the rules of the game by carving out an exception to the filibuster rules, as Joe Biden suggested this week. And they should not hesitate. It is time to end the charade of the debt ceiling forever. And if they do that, you never know what other possibilities might fall into place.

David Paul

David Paul is the founder and President of the Fiscal Strategies Group, a financial advisory firm specializing in municipal and project finance. Prior to forming the Fiscal Strategies Group, Dr. Paul was a Managing Director and member of the Board of Directors of Public Financial Management, Inc. Dr. Paul also served as the Vice Provost of Drexel University, and as the CEO of Mathforum.com, a mathematics and math education website and virtual community that is now part of the National Council of Teachers of Mathematics.

Dr. Paul is the author of When the Pot Boils: The decline and turnaround of Drexel University, and has published regular commentaries on politics and economics on The Huffington Post and Medium, and at appalled.blogspot.com.