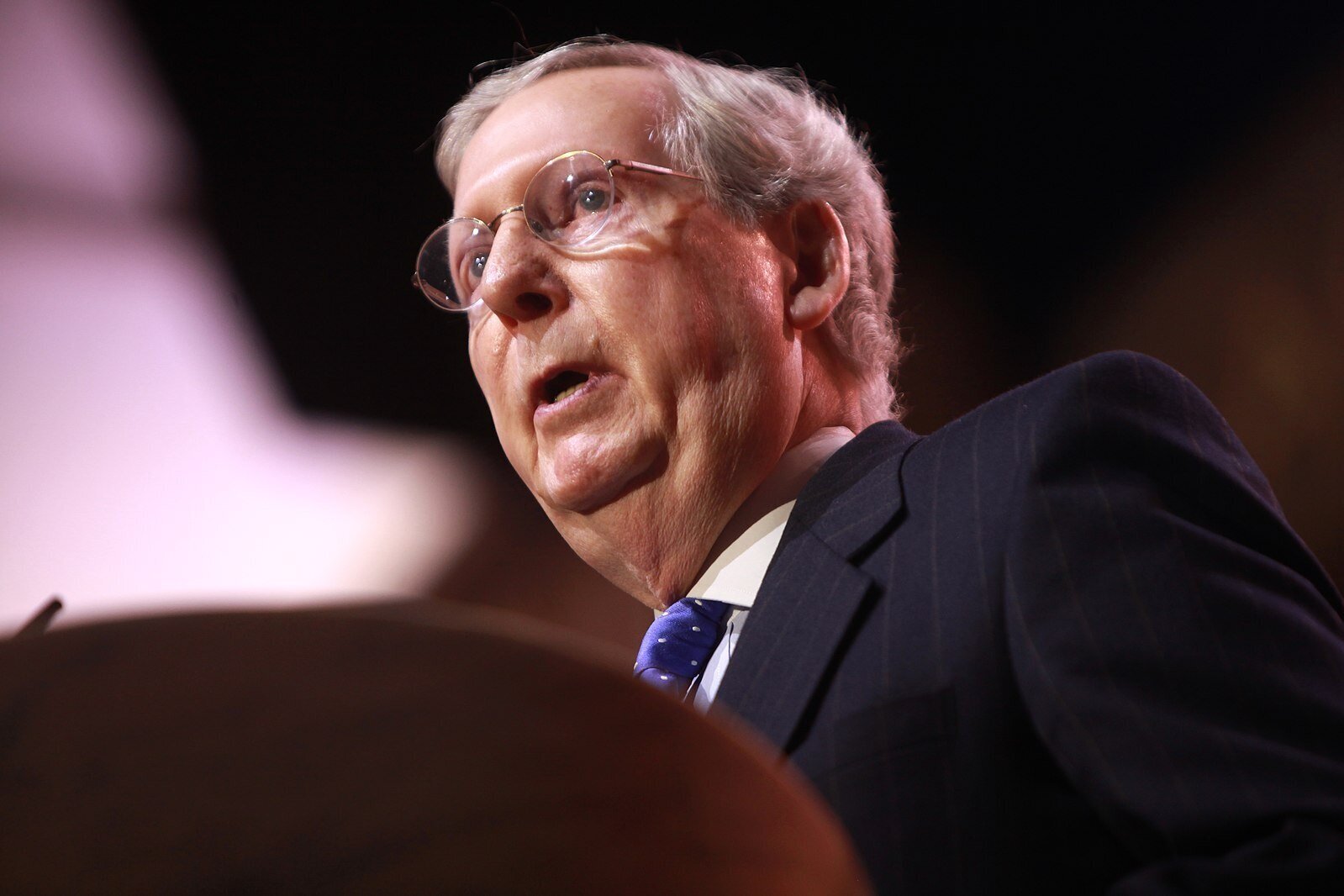

Inflation and crime are soaring – if you believe the headlines – and Mitch McConnell could not be happier. He desperately wants his old job back as Senate Majority Leader of the Senate, and had hoped that with Democrats in charge and eager to revert to their tax-and-spend ways, Republicans could simply dust off their age-old deficit hawk talking points and ride public anxiety about a growing national debt to flip the Senate back to the GOP in the midterm elections that are just sixteen months away.

Federal deficits, however, don’t seem to have the traction as a political issue that they once did. Since the 1980s, we have been warned of the ills that would befall the economy on the heels of federal deficits – from squeezing out capital for private investment, to sky-high interest rates, to insolvency and default. And yet, none of them has come to pass.

After Donald Trump layered on $8 trillion in new federal debt in just one term – the third-biggest increase in the national debt, relative to the size of the economy, of any presidential administration in U.S. history – one might imagine that even Republicans have become cynical of those Republicans who scream about deficits when Democrats are in charge, only to ignore them when the GOP takes back the White House and is ready to cut taxes. When The Wall Street Journal editorial board, historically the standard-bearer of conservative media, opined last month that it would prefer to see Congress add a hundred billion dollars a year to the federal deficit for ten years to fund the proposed bipartisan infrastructure bill, rather than give the IRS additional funding to crack down on tax evasion, you knew the era of the fire-breathing deficit hawks was behind us.

McConnell declared that inflation is “raging” because he needs people to believe it is raging. He says violent crime is “exploding” because he needs them to believe it is exploding. He needs those issues to be foremost on their minds because, according to Gallup, Democrats now hold the largest advantage over Republicans in party affiliation in a decade, and if Republicans are going to win back independent and suburban voters sixteen months from now and take back the Senate, he needs the 2022 midterm elections to be about something other than Donald Trump, January 6th, and Republican voter suppression.

Yet both issues are looming to be problematic for Republicans. When Federal Reserve Chair Jay Powell testified to Congress last week, he stuck to his view that while inflation ticked up over 5% in June – the largest year-over-year jump since August 2008 – it was only transitory in nature, not a foreboding sign.

Lumber has become the case in point. Over the course of the pandemic, lumber prices rose dramatically due to a combination of restricted supply and growing demand as the house-bound masses took on long-delayed home improvements. Then, as supply lines opened up and supply chain bottlenecks eased, prices have abated.

Similar patterns of dramatic year-over-year price increases can be seen in other industries that experienced supply and demand disruptions during the pandemic, and are now revving back up. Hotel and motel rooms, airline tickets, and car rental prices have all jumped up compared to last summer when travel demand fell off a cliff. Energy prices – a major factor in the Consumer Price Index (CPI) – have similarly increased as the economy is bouncing back and people are driving again.

But while Republicans are banging the drums about runaway inflation with the hope of stirring popular discontent, the bond markets are not convinced. Market projections of the anticipated ten-year inflation rate are reflected in the spread between the yields on the 10-year US Treasury Bond and the comparable term Treasury Inflation-Protected Securities (the “TIPS Spread”). Suffice it to say that while inflation fears spiked upward during the spring, market inflation expectations have settled back down, as market concerns have pivoted from inflation fears to indications that the pace of economic recovery – at home and globally – is slowing in the face of a rapidly spreading Delta Variant and vaccination hesitancy. The TIPS Spread is currently projecting a ten-year inflation rate of just over 2.3%, which is well below what Mitch McConnell is hoping for.

This is not to say that inflation is not a risk, but rather, as Jay Powell insists, that spikes in inflation as measured by the CPI may well be transitory. The underlying economic myth is that inflation has been under control for the past two decades or more as inflation in the CPI – which reflects the prices of those things that most people purchase on a day-to-day basis – has poked along at a compounded annual rate of just 2.1% over the past twenty years. During this same timeframe, however, asset price inflation (for stocks, bonds, real estate, cryptocurrency, etc.) has skyrocketed.

Inflation in asset prices has been a direct function of Federal Reserve Bank monetary policy, particularly the practice of “quantitative easing,” which is “Fed-speak” for printing money to purchase long-term bonds in the open market. Quantitative easing has worked to force long-term interest rates toward zero and played a large part in the global economic recovery from the 2008 financial collapse. Since then, the Fed has pumped nearly $7 trillion into the markets, an amount that is equal to nearly 50% of the U.S. money supply.

While traditional economic theory suggested that printing money causes inflation, all that new money never made it into the pockets of most Americans where it might have translated into inflation as measured by the CPI. Instead, it flowed through the financial markets into the accounts of the investor class, where asset price inflation is called by another name: wealth accumulation.

Like inflation, the problem of crime is in the eye of the beholder. According to a Morning Consult poll released last week, three-quarters of Americans now believe that violent crime is a major, growing problem. However, while this number is roughly the same among Republicans, Democrats, and Independents, the perceived cause falls predictably along party lines. Just over half of those polled blame rising crime on the proliferation of guns while the other half blame calls to defund the police.

Although violent crime often grabs the headlines, a deeper dive into the Morning Consult numbers suggests that crime is not as much of an issue in most people’s daily lives. While three-quarters of Americans suggest that violent crime is a major problem nationally, the problem appears to diminish the closer to home one gets. Only half of those polled – regardless of political affiliation – think major crime is a problem in their state, while the number falls to one-third or less when people are asked about crime in their own community.

The notion that fear of violent crime is being trumped up for political advantage is reinforced by Gallup polling on the issue. According to a Gallup tracking poll, people’s fear of crime in their own community is at the lowest level it has ever been since Gallup began asking the question in the 1960s. Its most recent result, less than a third of respondents thought that crime was a major problem in their community, mirroring the Morning Consult results noted above. As Paul Krugman observed recently, despite the increase in homicides nationally, “New York is still safer than it was a decade ago, vastly safer than it was 30 years ago, and, for what it’s worth, considerably safer than, say, Columbus, Ohio.”

Mitch McConnell wants his old job back and knows that Independents and suburban voters hold the key. Fearing that the 2022 elections will be a referendum on Donald Trump, January 6th, and the GOP voter suppression, he desperately wants to change the subject. Inflation and crime are the best he has been able to come up with. But try as he might to instigating public outrage on these issues, the numbers tell a different story.

David Paul

David Paul is the founder and President of the Fiscal Strategies Group, a financial advisory firm specializing in municipal and project finance. Prior to forming the Fiscal Strategies Group, Dr. Paul was a Managing Director and member of the Board of Directors of Public Financial Management, Inc. Dr. Paul also served as the Vice Provost of Drexel University, and as the CEO of Mathforum.com, a mathematics and math education website and virtual community that is now part of the National Council of Teachers of Mathematics.

Dr. Paul is the author of When the Pot Boils: The decline and turnaround of Drexel University, and has published regular commentaries on politics and economics on The Huffington Post and Medium, and at appalled.blogspot.com.