Headlines

April 26, 2024

Daily Trojan

USC Cancels Graduation

USC has canceled its main stage commencement and will require tickets, security screening, and a clear bag policy for attendees at remaining satellite ceremonies and miscellaneous events.

Reuters

TikTok Would Rather Shut Down

ByteDance would prefer to shut down TikTok in the U.S. rather than sell it if unable to counter a ban legally, due to the app's role in its overall business and the importance of its core algorithms.

Showbiz411

Female Judges Overturn Weinstein

Harvey Weinstein's NY conviction was overturned by a mostly female panel of judges, citing trial court errors in allowing testimony from women not involved in the charges, leading to a new trial.

Miami Herald

Melania Trump Flies Under the Radar

Melania Trump, who has been notably quiet recently, launched a $245 necklace called "Her Love & Gratitude" for Mother's Day, which includes a gold-plated pendant and a limited-edition NFT.

CNN

New Poll: 24% Might Reconsider Trump

Only 13% of Americans believe Trump is treated like other defendants, with opinions divided on his treatment's fairness, and 24% of his supporters may reconsider their support if he's convicted.

Associated Press

Enquirer Is a Shadow of Former Self

Testimony in Trump’s hush money trial has exposed significant corruption at the National Enquirer, potentially marking the end of its influence, according to former executive Lachlan Cartwright.

StudyFinds

Coke and Pepsi Drive Plastic Crisis

A study in "Science Advances" reveals that major corporations like Coca-Cola and Pepsi are major contributors to global plastic pollution, responsible for about a quarter of the world's plastic waste.

The New York Times

Being Stuck In Court Is Great for Trump

Trump's presence in a New York courtroom during his trial may benefit his campaign by casting him as a victim fighting perceived injustices, potentially boosting his appeal to his base.

CNBC

The GDP Is Less Than Expected

In early 2024, U.S. economic growth was weaker than anticipated at a 1.6% rate, with rising prices and inflation outpacing forecasts, according to a Commerce Department report.

Voice of America

U.S. Record Low Fertility Rates

The U.S. fertility rate fell in 2023 below pre-pandemic levels, with a record low in teen births and a shift towards later motherhood, influenced by the pandemic, the economy, and abortion restrictions.

The Hill

D.C. Gets Ready to Unwind and Exhale

Washington, D.C., is gearing up to unwind at the White House Correspondents’ Association dinner, which will feature Biden and SNL's Colin Jost amidst global conflicts and election tensions.

Los Angeles Times

Reggie Bush's Heisman Travels

Reggie Bush, former USC running back, won the Heisman Trophy in 2005, returned it in 2010 amid NCAA sanctions, and reclaimed it in 2024 following NCAA rule changes on athlete compensation.

Politico

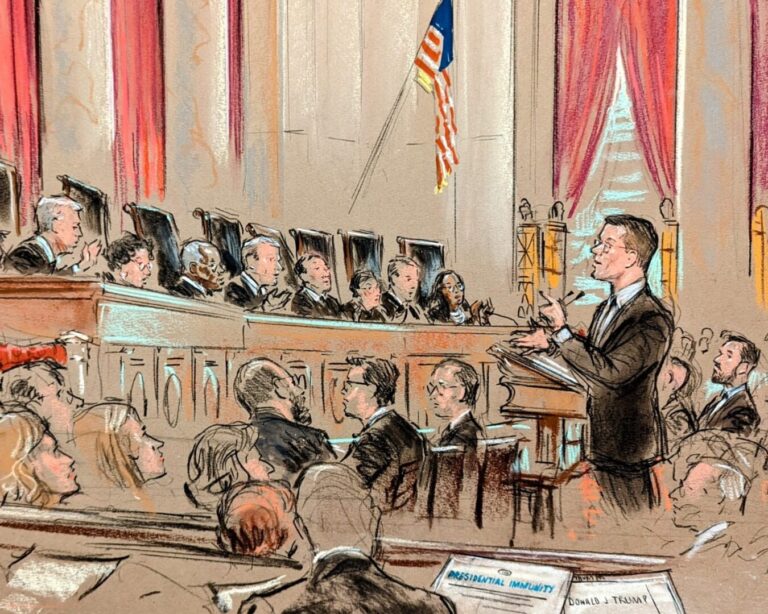

What's It Like Inside Trump Court Room

POLITICO reporters describe Trump's high-stakes Manhattan trial, highlighting intense security, media scrutiny, and strategic political plays within a restrictive and secretive legal setting.

NBC News

Robert Kraft Condemns "Jew Hatred"

Robert Kraft, New England Patriots owner, compared rising antisemitism on U.S. college campuses to pre-Holocaust Germany and called for strong leadership to combat it in a CNBC interview.

FiveThirtyEight

FiveThirtyEight Publishes '24 Averages

538's interactive polling averages for the 2024 election show Biden and Trump nearly tied nationally, with Trump leading slightly in swing states and new uncertainty intervals highlighting data variability.

Mediaite

Israel-Palestine Barely Mentioned

A recent Harvard poll shows that while young Americans favor a permanent ceasefire in the Israel-Hamas conflict, it ranks 15th out of 16 in importance among other surveyed issues.

New York Post

Target Employee Stops 3 in Theft

A vigilant Target employee in New Jersey thwarted three women attempting to steal a shopping cart filled with nearly $600 worth of merchandise, causing them to flee in their vehicle.

CBS News

For Sale: Sinatra's Townhouse

Frank Sinatra and Mia Farrow's former New York townhouse, a historic 19th-century property on the Upper East Side, is now for sale, featuring over 3,700 square feet and listed at under $4.5 million.

USA Today

Google Fires Employee Protestors

Google, known for supporting employee activism, called the police and fired workers who protested a $1.2 billion Israeli government contract with sit-ins at its New York and Sunnyvale offices.

For the Left

For the Right

Independent doesn’t mean indecisive.

© 2024 Smerconish. All rights reserved.

© 2024 Smerconish. All rights reserved.

News Links

Contact Links

Balance Delivered Daily

Get the Smerconish.com daily newsletter.

We will NEVER SELL YOUR DATA. By submitting this form, you are consenting to receive marketing emails from: Smerconish.com. You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Aweber

Privacy Policy | Website design by Creative MMS

Privacy Policy | Website design by Creative MMS