Headlines

March 7, 2026

Axios

Trump Demands “Unconditional Surrender”

President Trump told Axios Friday that his demand for Iran's "unconditional surrender" could mean the complete destruction of the regime's military capabilities — not necessarily a formal surrender.

NBC News

Russia Providing Intel to Iran

The assistance could help Iran locate American warships, radar or other communication systems, but there's no indication Moscow is helping direct Iranian strikes, sources tell NBC News.

Express

Iran Threatens To Nuke Israel

Iran has shared a chilling image of a nuclear missile striking an Israeli city, which appears to be Tel Aviv. In a post on X, the account previously belonging to Supreme Leader Ayatollah Ali Khamenei warned that "Khorramshahr is ahead"

NPR

84% of Republicans Support the War

As war with Iran heads toward a second week, most Americans say that they are against the military action and disapprove of how President Trump is handling it, according to the latest NPR/PBS News/Marist poll.

CBS News

Airstrikes Alone Can’t Change Regime

U.S. and Israeli airstrikes alone are unlikely to result in the ouster of the Iranian government, according to an expert in air campaigns, who said that the risks are growing for a more drawn-out war that could spread beyond the Middle East.

USA Today

Troop Complaints Over Religious Freedom

The United States' war in Iran has heightened existing concerns among some service members about the influence of Christian nationalism on the military under Pentagon chief Pete Hegseth's leadership.

The Wall Street Journal

Prediction Markets Drive College Frenzy

Prediction markets on college campuses are gaining popularity, enabling participants to trade contracts on event outcomes, though concerns about ethics and gambling risks persist.

The Washington Post

Don’t Imprison Parents for Their Kids

The guilty verdict Tuesday in the murder-by-proxy trial of a father whose son is accused of killing four people in a school shooting in Georgia sets a devastating and absurd precedent for imprisoning people for essentially being bad parents.

Variety

Ellison Vows CNN Independence

With David Ellison‘s media company poised to snap up CNN’s parent company, staffers at the news cable outlet have expressed fears that Paramount Skydance will steer CNN’s coverage toward a more conservative ideological bent.

Associated Press

Time To Debate Our Clocks Again

Even though polls show most people dislike the system that has most Americans changing clocks twice a year, the political moves necessary to change the system haven’t succeeded because opinions on the issue and its potential impacts are sharply divided.

ABC News

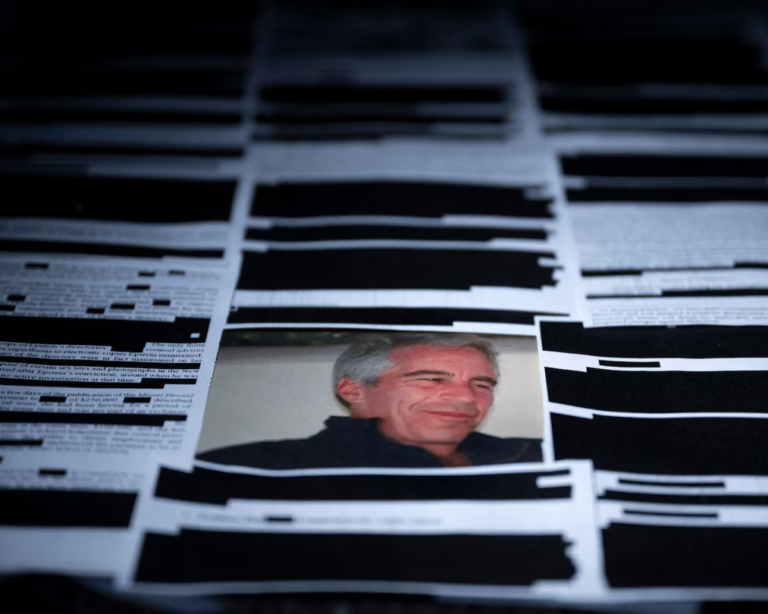

Files Released With Trump Claim

The Department of Justice on Thursday released three previously withheld FBI interview reports from 2019 related to a woman who made uncorroborated allegations that she was abused by Donald Trump in the 1980s, when she was a minor.

Politico

Dems Debate Whether To Spend in TX

Enthusiasm remains high for the party’s Senate nominee, James Talarico, but national Democrats aren’t sure how far they should go to support him — particularly if Sen. John Cornyn emerges from the GOP runoff in May.

The New York Times

Daryl Hannah: It Never Happened

Daryl Hannah explores the high-profile romantic relationship between her and John F. Kennedy Jr. in the early 1990s, highlighting the challenges they faced under media scrutiny and the impact on their personal and professional lives.

Barbara Fried

SBF Mom: “I’m Ending My Silence”

Sam Bankman-Fried’s mother argues for his innocence, criticizing the media’s "one-sided" portrayal and sensationalism. She highlights his 25-year sentence's personal toll and his commitment to the truth.

Mediaite

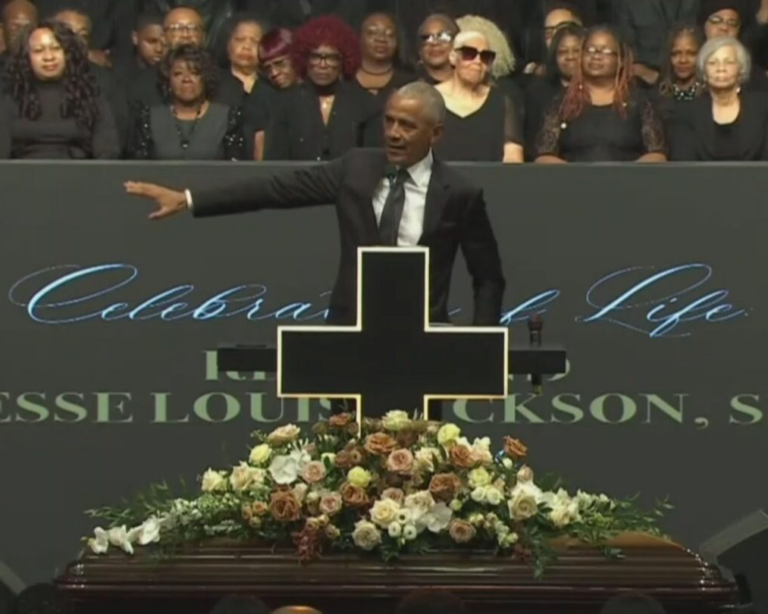

Obama Critiques Trump

Former President Barack Obama sounded off on President Donald Trump and his administration in a series of thinly-veiled attacks at Reverend Jesse Jackson’s funeral on Friday.

CNN

Trump Predicts Cuba’s Fall

“Cuba is gonna fall pretty soon, by the way, unrelated, but Cuba is gonna fall too. They want to make a deal so badly,” he told CNN’s Dana Bash in a phone interview when touting US military success in his second term.

CNBC

Jobs Growth Slows in February

Nonfarm payrolls in February fell by 92,000, compared with the estimate for 50,000 and below the downwardly revised January total of 126,000. It was the third time in five months that the economy lost jobs.

New York Post

Real Reason Noem Stayed Married

Bryon Noem‘s family members are hoping he finally leaves his wife, Kristi Noem, after the ultimate “humiliation” from her alleged affair with a top adviser — but fear he’ll continue to stay in his marriage.

The Hollywood Reporter

TFCA Resignations Over Censorship

The Toronto Film Critics Association faced a mass resignation after a pro-Palestine speech was censored, sparking debates on freedom of expression and the role of political discourse in artistic communities.

For the Left

For the Right

Independent doesn’t mean indecisive.