President Joe Biden’s proposed spending, in excess of entire fiscal (FY) budgets, shows evidence of extraordinary financial ambition and effort to re-engineer America in ways that may exceed that of Franklin D. Roosevelt’s ‘New Deal’ during the Great Depression.

There are parallels between the two, namely a major economic downturn; however, the cause of these downturns helps illuminate the solutions. Whereas the Great Depression was the result of uncontrolled capitalism and insufficient government regulation, the current crisis is one created by government actions, albeit in response to a virus. It was the result of extraordinary interventionism.

Well-intentioned or not, government decisions actively decimated the economy and sent 22 million workers home, or to the unemployment line where they were to wait for their government stipend. Now, claiming to be the solution to the very problem it helped create, the government’s proposed stimulus plans may prove larger than the New Deal itself.

The Biden administration’s partisan progressive handling of the economy gives some evidence that the nation got the socialist president they did not want, which may be precisely what the outspoken democratic-socialist Alexandra Ocasio-Cortez (AOC) meant when she indicated the president had already “surpassed progressives’ expectations.”

Through Biden, Congress has proposed returning to the era of pork-barrel spending with attempts to add discretionary spending on district projects into the upcoming federal budget – including things such as $3M for a smartphone app to track buses in Utah or $1M to provide “comprehensive, culturally relevant medical and mental health services to the African American community” in Berkeley, among others.

Although the argument can be made for the inclusion of special projects to curry votes and bipartisanship – in fact, there are some who would say the elimination of such deals began to break Congress – it clearly results in benefiting select, approved, communities and politicians.

In other words, Congress would be picking the winners and losers in the most obvious of ways, leaving the bill for everybody.

Should Coastal Tax Policies Go National

For centuries, debate has ensued over the degree to which governments should be actively involved in the economy, whether the populace is better served by an active hand or hands-free approach. This conflict is clearly exemplified between the pro-government solutions approach of Barrack Obama to the pro-business solutions approach of Donald Trump.

The Biden-Harris administration understandably favors the Obama-Biden approach to the economy and wealth generation; however, the spendthrift tone established by the new president – which more conservative economists might consider reckless – has not been met without warnings from liberal economists as well. This includes inflationary concerns coming from advisors such as Larry Summers, former Director of the National Economic Council under Obama, who has repeatedly warned against excess spending, most recently suggesting the economy is at risk of “overheating.”

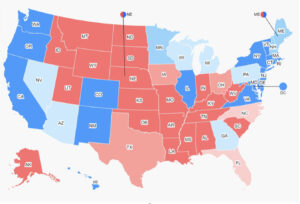

But the administration is clearly moving forward, dismissive of these concerns, instead, opting to bring a more liberal California or New York approach to the federal government, only with the added power to ‘print money.’ In doing so, it seems unconcerned with the potential negative consequences of such governance, namely, that the economic policies of these states have driven residents out while states with more libertarian policies, such as Texas and Florida, continue to attract Americans.

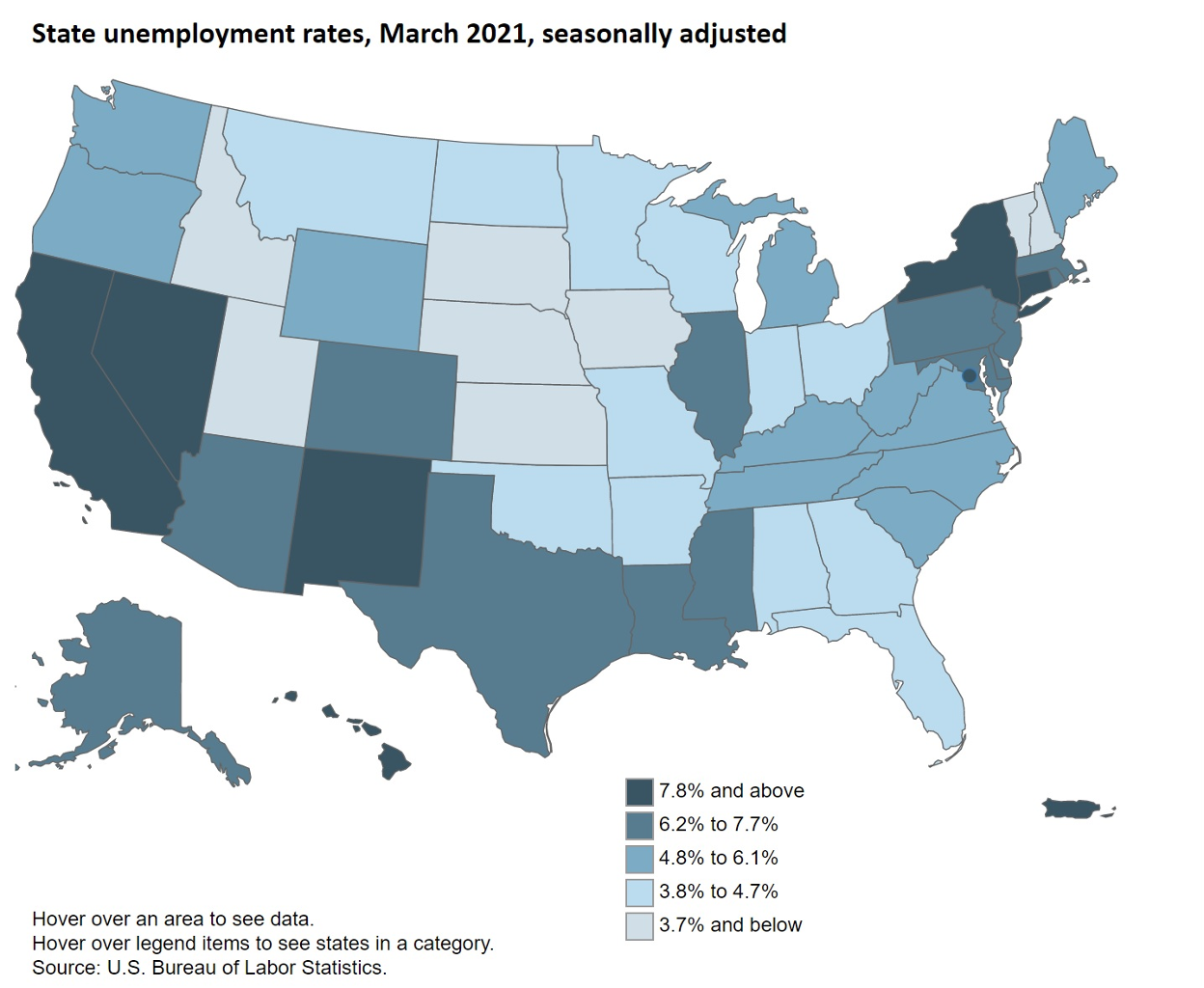

Not unsurprisingly, the most recent unemployment map largely resembles the 2020 election map:

Rather than holding to, and promoting, the more traditional laissez-faire model that guided the nation’s dominant economy for decades, the Biden administration is taking steps to reshape the role of capitalism in the US leaving economists like Mark Zandi to recognize that “every corner of the country is going to be touched by this in some way.”

To get there, the proposals include increases in tax rates, most notably the corporate tax rate, which was lowered in 2017, an attempt to make the US more competitive with other nations. If passed as currently conceived, the new rate – raising it from 25.8% to 32.3% – would become the second-highest amongst G20 nations. In addition to losing workers or limiting hiring capacity, an effort to offset the loss in revenue (or profits) would likely be passed along to consumers and existing wages, possibly stalling economic growth in the process.

There are even those who suggest the president may prefer the modern China model in which the government is the biggest player. By comparison, China, despite its communist policies and confiscatory practices, has continued to attract and retain businesses with its lower tax rate (25.8%), exemptions and incentives.

Punishing success and profits while disincentivizing risks does little to promote growth.

What About Working?

Biden has consistently stated that he will not directly raise taxes on those earning less than $400,000 per year. Whether his proposals can proceed without raising taxes elsewhere remains to be seen; however, the first step to earning is working, and policies must be designed, in some measure, to encourage work.

With enhanced unemployment insurance (UI) provisions provided during the pandemic – such as tax exemptions and plus-up benefits that raise the payments beyond the pre-established amount – this supplemental relief may be disincentivizing a return to work, another government action that could easily slow the recovery. Conceptually, the added benefits should provide relief for those who would have remained employed were it not for the pandemic, and thus prevented from earning at their potential rates – rates they may require keeping up with their living expenses.

Despite the economy’s upward trajectory, a supplement was extended in the 2021 bill, leaving the more cynical to wonder if Democrats are trying to extend unemployment itself.

The White House denies that these factors are affecting a return to work, suggesting there is no evidence to support the claim. But if a worker is paid nearly as much, if not more, to stay home, why would he/she want to return?

Not dissimilar in philosophy to paid leave, the unemployed have been granted the authority to live with a semi-permanent paid vacation. Under such conditions, refraining from rejoining the workforce is a practical life and financial decision for many.

The concept of UI has always been to provide a safety net in the event one unexpectedly loses a job and cannot quickly gain employment, which is why there was a two-week delay in qualification. Now, added benefits and extended length provide a legitimate alternative to working or purposefully seeking to find work.

Unemployment insurance was never meant to be permanent or make one whole, which is why there have been limits and caps – particularly for high earners – but low-wage earners are benefitting to a greater degree simply because they can sustain their lifestyle without having to go back to work. This has proven quite common among young adults, who have been returning to their parents’ homes in such large numbers that for the first time since the Great Depression, a majority have moved back. With such moves comes less financial responsibility, less need for gainful employment.

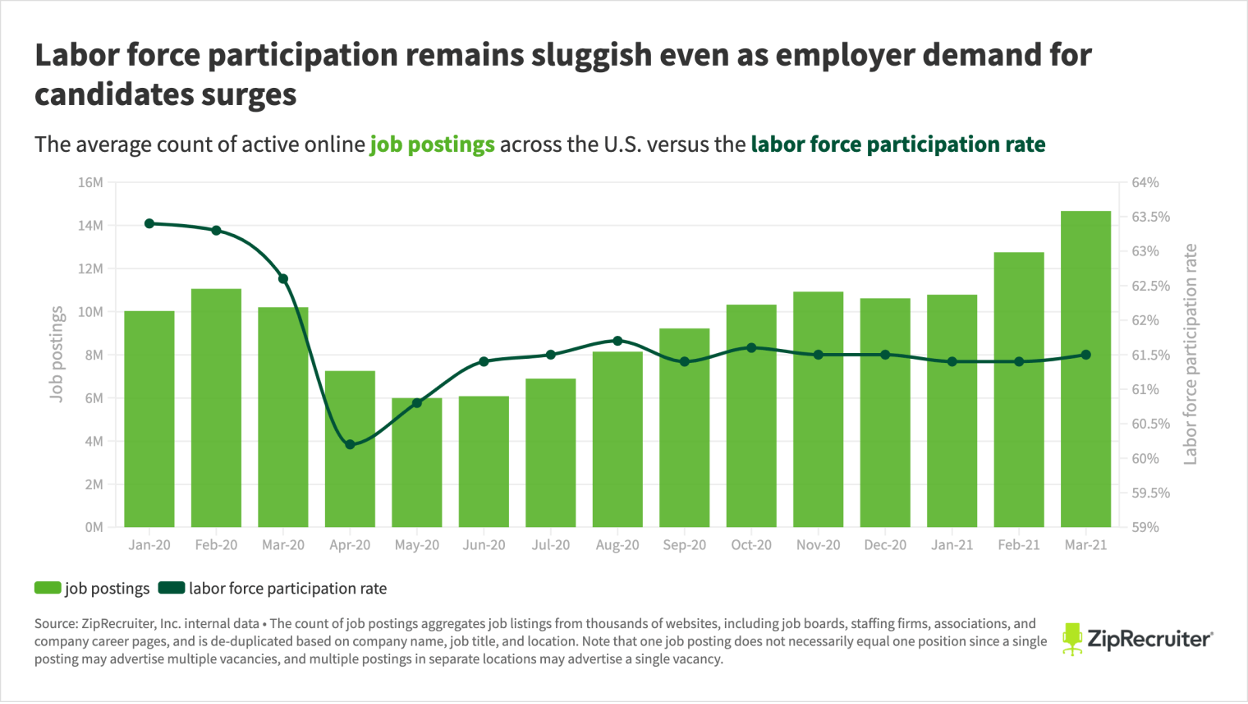

Per the latest jobs report, there were a record 8.1M jobs available, yet the national unemployment rate rose to 6.1% with a 75% reduction in jobs added. With labor force participation continuing to remain underwater, there is a clear disconnect between Washington think tanks, workers, and the employers that are increasingly complaining of the difficulty in finding those willing to go back to work.

The president recently announced that UI recipients who are offered jobs must take them but it is unclear how such rhetoric will be enforced.

Made worse, the Biden administration has tacitly approved of policies that prevent a practical return to the workforce, such as teachers unions’ refusal to allow in-person learning for children, leaving a disproportionate number of women home as they remain caretakers.

In what may prove beneficial to the president, whether by accident or design, weakening the economic recovery provides additional support for more spending in the name of ‘stimulus’ and ‘recovery.’ In other words, the more money spent, the more damage can be inflicted, the more money can be spent to solve the damage created.

Beyond any impacts to the oft-criticized corporations, current policies have left small businesses competing for employees with a government that has no bottom dollar. In many cases, employers have been left offering minimum wage jobs at rates less than the government’s offer of non-work. Consequently, several states – particularly those with lower costs of living – have begun proposing work requirements, employment incentives, and cancelations of the UI plus-up benefits.

It will be interesting to gauge which state policies yield more rapid results.

Inflation or Stagflation?

As the nation struggles to rebound from the economic downturn and many Americans are experienced caps on income – a function of UI benefits – there are early indications that prices are rising on consumer goods. Although these increases have been recognized by Federal Reserve Chairman, Jerome Powell, who described them as “transitory,” there are indications that this may be understating the situation. One month after passing the latest trillion-dollar bill, consumer prices showed a year-over-year increase of 2.6%, more than economists had predicted, and not simply assignable to rising fuel prices. The effects of inflation were felt more broadly.

The next month’s report was even more dramatic, again exceeding economists’ expectations, showing a rise of 4.2%, the fastest increase since 2008. Even excluding the more volatile prices of food and energy, the core Consumer Price Index (CPI) rose 3% since the first trillion-dollar bill was passed in March 2020. Although the Federal Reserve continues to define this as temporary, inflation is becoming real, not coincidentally following the injection of over $4T into the economy.

And since lower-wage earners spend the highest percentage of their income on essential products, these impacts are affecting the more economically vulnerable members of society – the very class the Biden administration professes to prioritize. Although promising not to raise taxes on the lower and middle classes, this could be described as a ‘hidden tax’ on all Americans.

If, however, increases in wages result to both incentivize workers to rejoin the workforce and pay for the increase in goods, that additional spending capacity could further exacerbate the growing inflation. It will create a vicious cycle that begins with money flows and currency is devalued.

And if these are indicators of the impact that $4T in spending had over the course of a year, what will happen if Biden’s additional $4T in spending passes in only a few months? According to economists like Jeremy Siegel, the resulting inflation could reach as high as 20%. If this course is permitted to persist, inflationary factors could largely wipe away all economic gains, leaving Americans in a pre-pandemic position familiar to January 2020.

The last time the US experienced the combination of stagnant economic growth, high unemployment, and high inflation was the decade following the passage and implementation of Lyndon B. Johnson’s (LBJ) Great Society. When met with the restricted oil supply, the US experienced a period of stagflation in the 1970s.

In what one would hope is not a harbinger, in addition to the expansionary policies promoted by the administration, Biden has moved to limit, albeit largely symbolically, US oil production through banning new drilling on federal lands.

On the Line

With so much on the line, the administration may want to consider the extent to which it is rapidly waging a national progressive experiment. Its failure, in the words of Democratic economic advisor, Steve Rattner, could “set back the cause of progressivism for several more decades.” Such failure may prove Biden more a Jimmy Carter than LBJ, and the former was quickly and decisively replaced by Ronald Reagan, who would lead the nation into its most conservative era since the 1950s.

More likely, as with the greatest of economic woes, as experienced ahead of World War II, it was not simply the spending programs that solved the crisis. It was monetary policy, the cyclical nature of markets and the wartime economy.

Despite claims to the contrary, a nation cannot simply spend itself out of economic hardship. In a productive society, the citizens themselves must be productive. They must work, and policies that prioritize that fact consistently succeed.

President Biden believes his plan does this, but in reality, his pandemic policies have left many Americans dependent on their government. Still, despite Biden’s continued efforts to expand its influence in their lives, the public continues to trust businesses more than governments. Before becoming hooked on these subsidies, the nation is likely to demand a return of the more traditional roles of business and government, and with it, an enhancement of their individual economic rights.

In the meantime, how much government and how many trillions will Americans see?

______________________________________________________________________________________________________________________