People really, really hate it. After that, things get complicated. Like orchids, inflation comes in a lot of varieties, and each variety has its own causes and consequences. First, inflation, by definition, is an increase in the price of goods and services. Because it is an “increase,” prices do not fall back down once inflation ends – they simply stop increasing. So, for most products, even if inflation ended (which it won’t – it is only going to slow down), their prices would not return to their pre-inflation level. For prices to fall back to some previous value would require deflation, which has its own set of problems that are at least as severe.

Now for a little taxonomy. There are two broad varieties: demand-pull inflation and cost-push inflation. In demand-pull inflation, prices are rising because the economy is robust: goods are in demand, resulting in a direct increase in prices, and workers are in demand, resulting in an increase in wages, which, as a cost of production, will indirectly increase prices. In cost-push inflation, prices are rising because of an increase in the cost of production independent of the state of the economy.

Demand-pull inflation is the more benign of the two because the robust economy will pull up prices and wages together. In addition, because the economy is robust, jobs are being created, and the unemployment rate is falling. Cost-push inflation, however, almost always results in a reduction in real spending power (what economists call the real wage) because the initial increase in costs is generally not labor costs. In the U.S. economy, wages are more reactive to the state of the economy than proactive. Moreover, cost-push inflation slows the economy down and can result in a loss of jobs (stagflation). Cost-push inflation angers people because they view inflation as having robbed them of their wage increases. But in reality, the original cost increases were the cause of the reduced real wages. Inflation was simply the mechanism by which this happened.

What makes the current period so complex is that the COVID-19 epidemic inflation contained all of the varieties. The Covid-induced supply chain distortions were an example of cost-push inflation. When consumers switched their purchases from in-person services to consumer durables, demand-pull inflation was generated. The stimulus packages passed by the Trump and Biden administrations generated additional demand-pull inflation. The outcome with respect to real wages was the result of a tug of war between these forces. Over the last four years, however, a robust economy and productivity growth have won. The average real wage has increased by 2.8%, and the median real wage has increased by 1.7% – not spectacular but impressive given that the period included a substantial episode of cost-push inflation.

Looking at averages (and medians) is important, but there is better news if one looks deeper. For the bottom 25% of the worker wage distribution, real wage increased by 3.2% over the period. Real wages of workers who are now 29-38 years old have increased 12.2% over the period. There are 2.2 million more jobs now than were forecast prior to the pandemic. So, the U.S. economy has more jobs now than economists thought would be the case had the pandemic never happened. Jerome Powell, the Chairman of the Federal Reserve, recently said, “Let’s be honest, this is a good economy”. Being over 30 and in a position of authority, no one, of course, will believe him, but that doesn’t mean he is wrong.

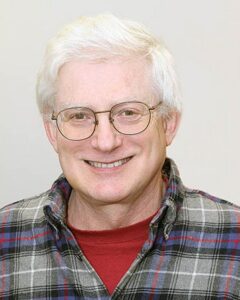

Mark Kuperberg is a Professor of Economics at Swarthmore College, with a specialization in Macroeconomics and the Economics of Education.